Fast, Easy & Affordable Debt Collection in Turkey

As a foreign person or legal entity, collecting your debts in Turkey can be complex, difficult, and tedious. At this point, we, as lawyers who have encountered the same scenario repeatedly, equipped with experience, are here to accelerate this process for you, reduce your victimization, and provide you with maximum assistance.

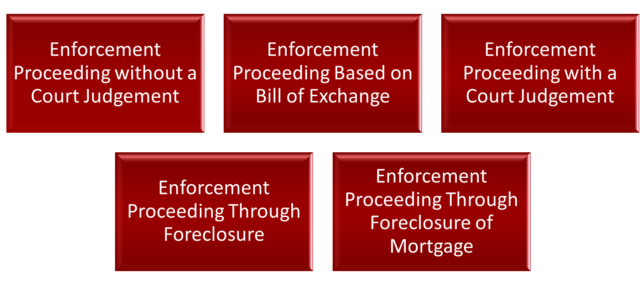

To briefly explain the execution procedure conducted in Turkey for your information, Turkish law includes multiple methods of execution proceedings, and the execution process is subject to a specific procedure. The relevant procedure always begins with the creditor’s debt collection request, and it varies in terms of the payment period and objections to the debt. In a scenario where the conditions of several methods of execution proceedings are met, the creditor has a right to choose which execution method will apply.

As wonderful news, you do not need any official document to be able to carry out the execution process in Turkey. Of course, having an official document obtained from the court or a bill of exchange will make your job even easier in certain situations. This aspect will be clearer when the methods of execution proceedings are explained in detail below.

Methods of Execution Proceedings

- Enforcement Proceeding without a Court Judgement

If you do not have any official document the procedure will be as follows:

In Turkish law enforcement proceeding without judgement is only applicable to money and assurance debts. The procedure begins with the creditor’s debt collection request made to the execution office.

The execution office who took that request must send a payment order to the debtor.

The payment order states that the debtor must pay the debt within 7 days. If the debtor claims not to have such a debt or claims the signature does not belong to him/her they must raise an objection to the relevant execution office; otherwise, execution proceedings will be initiated against them. If the debtor objects to this payment order, the execution proceeding will stop.

After this point, depending on the objection, the creditor can file various lawsuits. The creditor may file either an action for the revocation of the objection or an action for the abolition of the objection.

It is crucial at this stage to seek legal assistance to decide which lawsuit is in your favor and facilitate the procedure as much as possible.

- Enforcement Proceeding Based on Bill of Exchange

If you have a bill of exchange, it is more than marvelous. In this case the procedure will be as follows:

Due to this procedure is similar to the procedure described above, it is more accurate to present it in bullet points:

- Creditor’s debt collection request made to the execution office.

- The payment order must be sent by the execution office.

- The debtor who took the payment order must pay the debt within 5 days or object to the debt and/or the signature to the execution court.

- It is crucial to emphasize that these objections do not stop the execution proceedings at this point.

- Filing a lawsuit for debt collection

- Enforcement Proceeding with a Court Judgement

If you have a court judgement the debtor will not be able to avoid paying the debt. Let’s analyze the procedure for collecting your debt without making you more curious.

- The debt collection order (in the enforcement proceedings without a court judgment it is referred to as the “payment order”) sent by the execution office.

- The debtor who took the debt collection order must pay the debt within 7 days otherwise the execution office will enforce this obligation by legal means.

The advantage of having an official document from the court is that the debtor does not have the right to object. However, it should be noted that there is always a risk that the debtor may file a lawsuit regarding the debt.

- Enforcement Proceeding Through Foreclosure

You can initiate this enforcement proceeding either with a court judgement or without a court judgement. However, it is important to note that if you have collateral as assurance, generally, you will need to resort to the conversion of collateral to cash.

If the mentioned enforcement proceeding initiated with a court judgement, the detailed procedure for court decision execution, as explained above, will be applied and if it is initiated without a court judgement the procedure of it, as explained above, will be applied.

The only difference in this proceeding is that, after the payment order/debt collection order is sent, the debtor has 15 days to pay the debt or 7 days to object to the existence of the collateral and/or the debt.

- Enforcement Proceeding Through Foreclosure of Mortgage

This proceeding, which can be initiated with or without a court judgement, leaves almost no chance for your debt to remain uncollected.

The only difference in this proceeding is that, after the payment order/debt collection order is sent, the debtor has 30 days to pay the debt or 7 days to object to the existence of the collateral and/or the debt.

You Can Reach us for Debt Collection in Turkey

As Tercan Legal, Turkish Law Firm, we proudly embrace a success-oriented approach, committing ourselves to delivering legal services at the highest level. In legal processes, our focus extends beyond mere success; we elaborate to provide effective, immediate, and quality services. Additionally, our policy of only seeking fees upon achieving success reflects our unwavering belief in the effectiveness of the legal services we provide. By doing so, we consistently aim to offer our clients reliable, efficient, and fairly priced legal support.

You can always seek legal support from our experienced team to transform your debt collection process in Turkey from being a hassle into a fast and effective procedure and increasing your chances of successfully recovering your debt.